I found this interesting…

According to the National Association of REALTORS® Chief Economist, if the 30-year fixed mortgage rate dropped to 6%, it could open the door to homeownership for 5.5 million more households.

Roughly 10% of those, about 550,000 buyers, would likely make a move within the next year.

That kind of demand could drive a 13% increase in home sales.

While a double-digit increase in sales over a single year is uncommon, the projection underscores how quickly buyer demand can surge when market conditions improve.

Today’s Topics:

Most Renters Want to be Homeowners

Post-Pandemic Shift: Rates Now Drive Buyer Behavior

Catch It Early: Open House Invitation

Nearly 60% of Renters Plan to Buy a Home

The Realtor.com August 2025 Rental Report shows that U.S. rents have fallen for 25 consecutive months, with the median asking rent across the 50 largest metros at $1,713, down 2.2% year-over-year. While rents remain 17% higher than pre-pandemic levels, they are still 2.6% below their August 2022 peak. Nearly 60% of renters still plan to buy homes, with half expecting to purchase within one to two years.

Rent growth is below the 2017–2019 average of 3.3%, showing a cooling market.

Rents declined across all unit sizes:

Studios: $1,430, ↓ 1.7%

1-bedrooms $1,593, ↓ 2.1%

2-bedrooms $1,897, ↓ 2.2%

Biggest drops since peak: Las Vegas, Atlanta, and Austin (each down ~13%)

Ralph’s Take

As nearly 60% of renters set their sights on homeownership, a drop in mortgage rates could unleash a significant wave of demand. In a market already constrained by low inventory, that influx of buyers could intensify competition and keep entry-level home prices elevated. With nearly a third of renters aged 25–34 preparing to purchase, sellers of starter homes, condos, and co-ops stand to benefit most from the momentum ahead.

Westchester Weekly Market Tracker 📈

‘Coming Soon’: 25 ↑+5

New Listings: 210 ↓-16

Price Reductions: 68 ↓-36

Pending Sales: 173 ↓-2

Closed Sales: 155 ↓-10

💰 Find your home’s value here: What’s my home worth?

Property Type: Residential. OneKey MLS, Inc. 9/19/25 - 9/26/25.

Post-Pandemic Shift: Rates Now Drive Buyer Behavior

In recent months, mortgage rates have slipped from 7.04% in January to around 6.30%, sparking renewed discussion about whether lower borrowing costs will unlock more demand. ResiClub’s 25-year analysis reveals wide swings in buyer sensitivity to mortgage rates, depending on the housing cycle. In some periods, demographics and credit standards mattered more. In others, rates barely moved the needle. But in the current post-pandemic cycle, mortgage rates have emerged as the dominant force shaping demand.

Early 2000s (2000–2004): Falling rates fueled the housing bubble

Housing bust (2005–2009): Demand collapsed despite lower rates

Post-crash (2010–2014): No correlation, demand muted despite low rates

Recovery years (2015–2019): Weak influence from rates

Pandemic era (2020–2024): Exceptionally strong link between rates and demand

Ralph’s Take

Today’s heightened rate sensitivity means even small shifts in mortgage rates can have a significant impact on demand. A modest drop may draw buyers back, while a sharp increase could push them out just as quickly. Case in point: when the average 30-year fixed rate hit its 2025 low of 6.26% two weeks ago, purchase applications jumped to their highest level of the year.

Catch It Early: Open House Invitation 🎈

OPEN HOUSE: Saturday, September 27th: 1:00 - 3:00pm

ADDRESS: 1504 Fox Glen Drive, Hartsdale

Enjoy the ease of townhouse-style living in this bright and beautifully updated two-story condo with oversized windows throughout. With its own private front entrance, covered porch, and upper-level balcony, this home provides both indoor style and outdoor enjoyment. Residents of The Colony enjoy ample parking, beautifully maintained grounds, a large in-ground pool with sundeck, and a fenced-in playground. A rare opportunity for low maintenance living with space, style, and amenities!

Just Missed the Cut

Mortgage Watch 📉

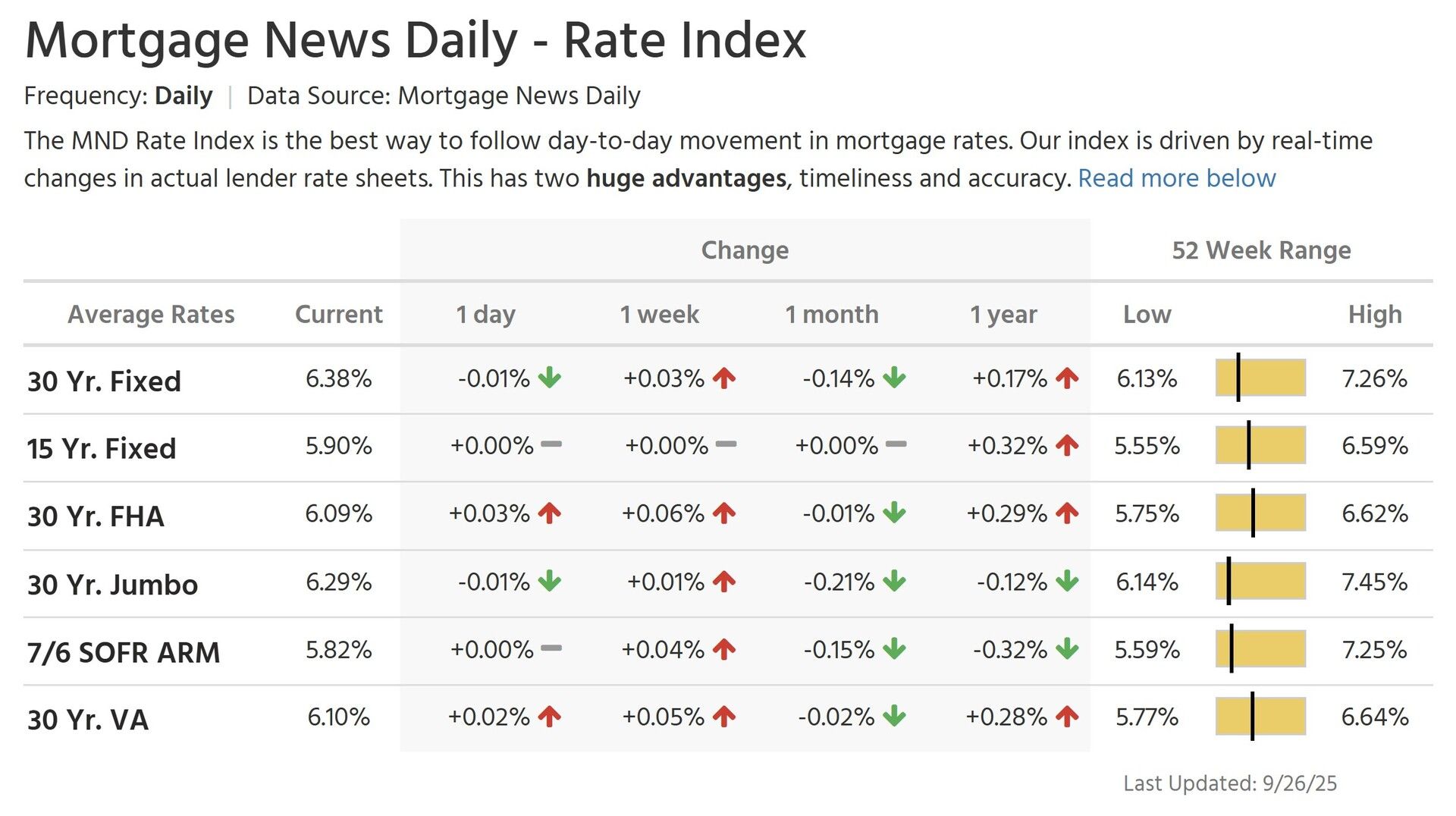

This week’s average 30-year fixed mortgage rate is 6.38% (⬆️ 0.02 from this time last week.)

> The rate you may be eligible for can vary greatly from the daily average published via Mortgage News Daily.

Things to Do in Westchester This Weekend

Saturday, September 27th

Armonk Outdoor Art Show, Armonk

Chappaqua Children’s Book Festival, Chappaqua

Community Yard Sale, West Harrison

Fall Festival: Fall Photo Fest, North Salem

Flannel & Fire, Bedford

Mystic Moon, North Salem

Oktoberfest, Croton-on-Hudson

Rev Fest 250, Croton-on-Hudson

Rocktoberfest, Irvington

Run for Recovery 5K, Yorktown Heights

Tack and Tweed Pop Up Event, North Salem

The Piano-Bar Show, Mount Kisco

Weir Tour, Ossining

Yonkers Comic Con, Yonkers

Sunday, September 28th

Armonk Outdoor Art Show, Armonk

Bicycle Sundays, Lower Westchester

Fall Car Show, Chappaqua

Fall Festival: Fall Photo Fest, North Salem

Hispanic Heritage Festival, Mount Kisco

Jay Day Fall Festival, Rye

Mystic Moon, North Salem

Rev Fest 250, Croton-on-Hudson

Sail Fest 2025, Tarrytown

Somers Women’s Club Annual Tag Sale, Somers

The Haunted Word: The Tales of Edgar Allan Poe, Armonk

The Westchester County Car Show, New Rochelle

This market is not perfect. I'm here to help.

Ready to tour properties?

Reply, call, or text message me: (914) 202-1101

—

Learn your home's value and find recent comparable sales here

—

With gratitude, Ralph 🫡