The financial markets were all over the place this week.

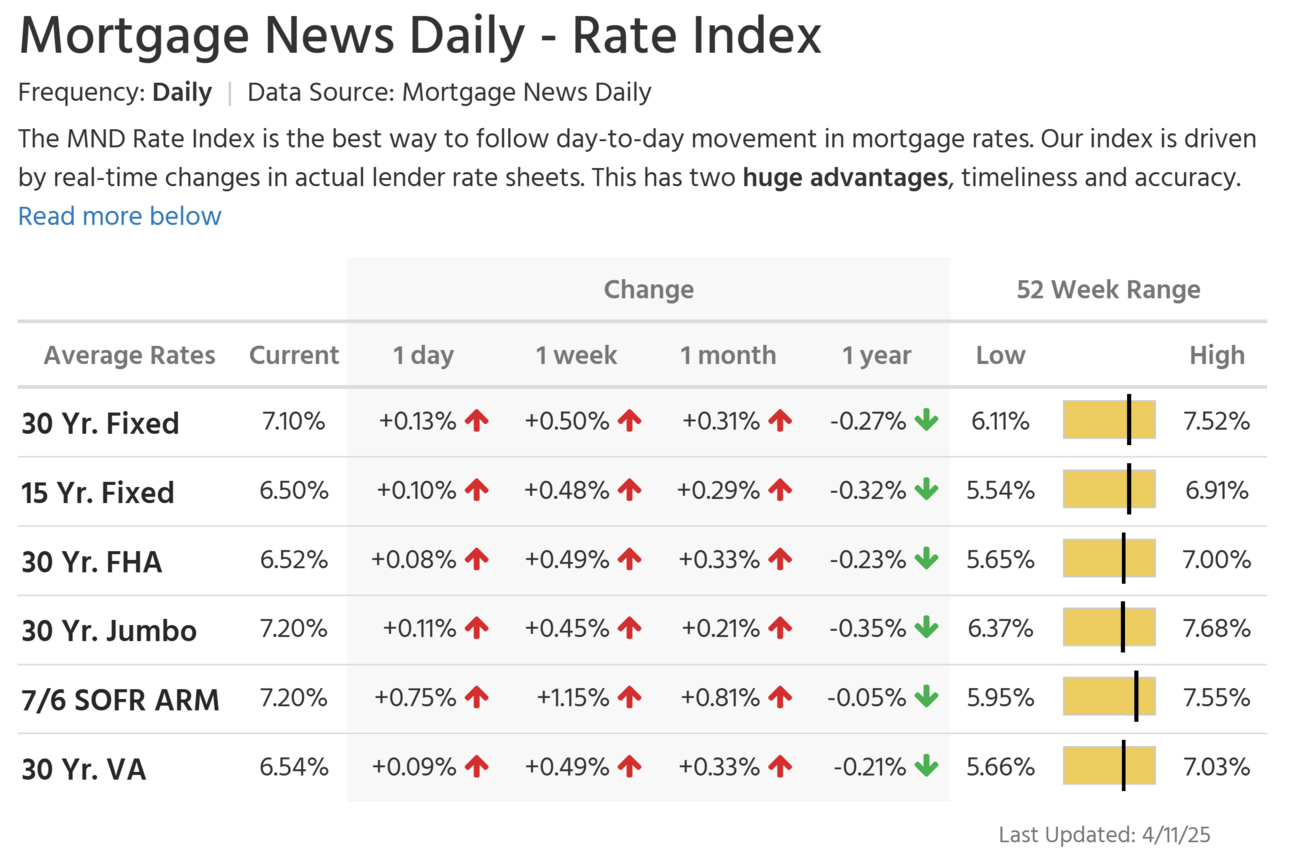

Stocks dropped early on, and bonds weren’t spared either. As bond prices fell, yields jumped — pushing mortgage rates higher. The average 30-year fixed mortgage rate now sits at 7.1%, the highest level since February 19th.

But here’s the silver lining: Volatility works both ways.

Last Friday, the average rate had dipped to 6.55% — the lowest point so far this year. That drop sparked a surge in activity: mortgage applications jumped 20%, hitting their highest level since September 2024, while refinance demand soared 35% in just one week.

Savvy buyers should be ready to lock in lower rates during the dips as they move through the homebuying process.

Today’s Topics:

👊 Real Estate vs the Stock Market

New York's LTVs Among Nation’s Lowest

House Flipping in 2025

Real Estate vs. Stock Market: Where’s the Smart Money Going?

Both have made millionaires, both come with risks, and both can be incredibly rewarding if approached with strategy and patience. In the wake of recent market volatility, many investors are reevaluating their portfolios, particularly weighing the merits of real estate versus stock market investments. A recent article from Realtor.com asks the question, “which is the better investment?” Let’s take a look:

Team: Stock Market 📈

Liquidity: You can access your money almost instantly.

Compound growth: Dividends and reinvestment can snowball wealth over decades.

Diversification: With ETFs and mutual funds, you can spread risk across sectors and regions.

Lower entry point: You can start investing with just a few dollars.

Team: Real Estate 🏠

Scarcity and demand: There's only so much land to go around.

Rental income: Smart investors use real estate to generate monthly cash flow.

Tax benefits: From depreciation to mortgage interest deductions, the tax code favors property owners.

Hedge against inflation: As prices rise, so do rents and property values, typically.

Ralph’s Take

Savvy investing isn’t about choosing sides — it’s about striking the right balance. A well-rounded portfolio doesn’t pit real estate against stocks; it leverages both. While you track the ups and downs of your stock investments, I’ll keep you informed on how your real estate is performing. Together, we’ll make informed decisions that move you closer to financial security. That’s how you level up.

Westchester Weekly Market Tracker 📈

‘Coming Soon’ Listings: 35 ↓-1

New Listings: 277 ↓-11

Price Reductions: 67 ↑+14

Pending Sales: 203 ↑+4

Closed Sales: 122 ↓-1

💰 Highest Over Ask: 28 Knollwood Drive, Larchmont: $1,300,000 - 42% over ask in 7 days.

Property Type: Single-Family. OneKey MLS, Inc. 4/4/25 - 4/11/25.

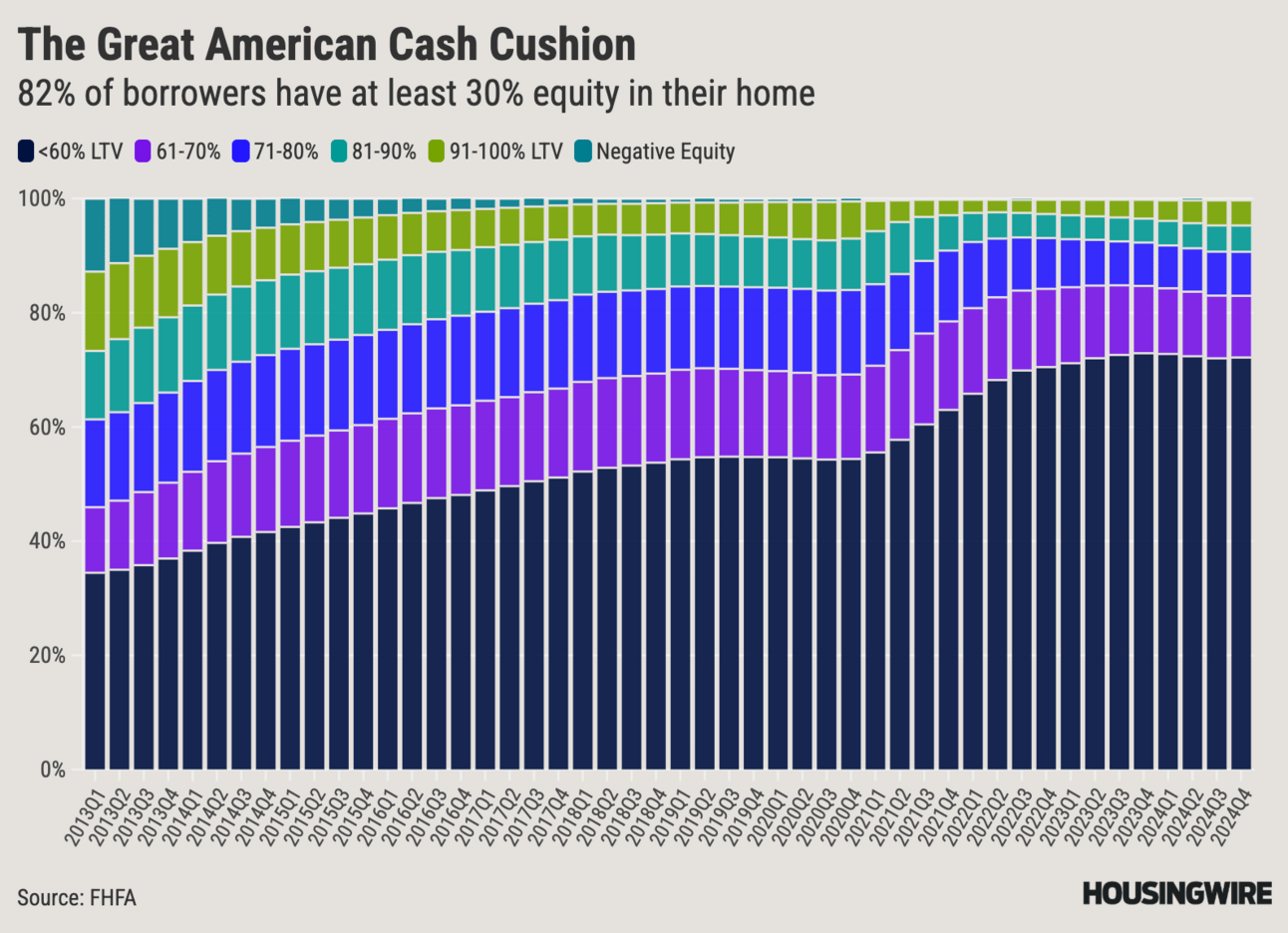

Locked-In & Loaded: Homeowners Sitting on a Mountain of Equity

According to new numbers from FHFA and BatchService via ResiClub, the national average loan-to-value ratio (LTV) sits at just 62.2%. That means the typical homeowner today owns nearly 40% of their home outright — a powerful financial position.

For reference: If a home is worth $400,000, and the mortgage balance is $320,000, the LTV is 80% (20% equity). A lower LTV = stronger footing. Nationally, that figure has plummeted, with some states far below average.

Ralph’s Take

This aligns perfectly with what we’re seeing in Westchester. Many sellers aren’t under pressure — they’ve built up significant equity and are comfortably locked into ultra-low mortgage rates. While that’s a good thing, it’s also a big reason inventory remains limited. Homeowners are opting to hold out until a major life change or financial incentive prompts a move. With New York ranking second nationally with the lowest loan-to-value ratios, local homeowners are in a particularly strong position.

Beautifully maintained and updated three-family home with charm, character, and excellent curb appeal. An ideal opportunity for both savvy investors and owner-occupants. Situated on a corner lot of a tree-lined street, the property includes three spacious units: a 3-bedroom, a 2-bedroom, and a 1-bedroom with dormered ceilings. Each features hardwood floors, large windows, and functional layouts. All three units are occupied by respectful, long-term tenants on month-to-month leases, providing income stability and future flexibility.

Whether you’re seeking a strong investment property or a multi-generational living setup, this home offers a wide range of possibilities.

🎈 Open House: Saturday 4/12: 1-3pm

📍 232 Westchester Avenue, Mount Vernon

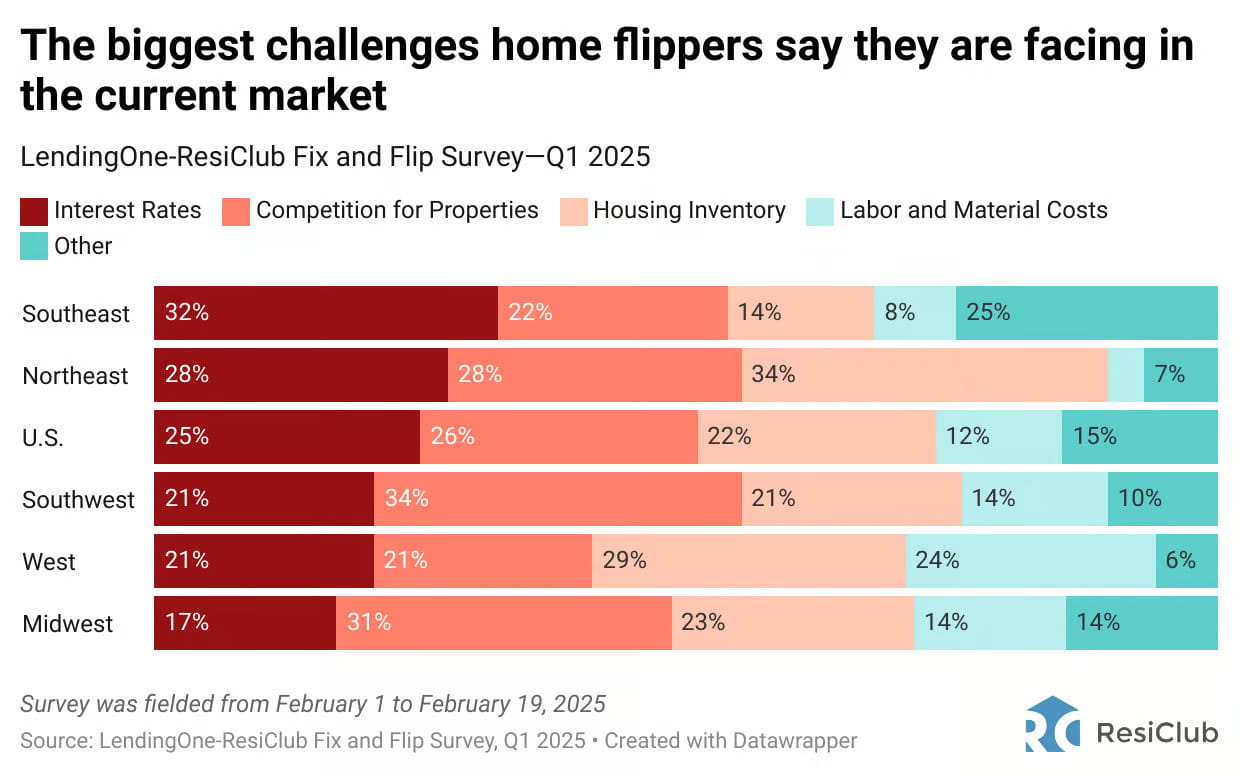

House Flipping in 2025: Margins Under Pressure

The LendingOne-ResiClub Q1 2025 Fix and Flip Survey highlights the cautious but ongoing activity in the home flipping market following the end of the pandemic-driven boom. While most flippers still plan to operate in 2025, they face increased regional challenges such as tight inventory, higher costs, looming tariffs, and financing hurdles. The Northeast remains competitive due to limited inventory and strong demand, whereas other regions cite different leading concerns such as borrowing costs and labor shortages.

89% plan at least one flip in 2025; 64% will use fix-to-rent strategies.

32% predict strong spring 2025 demand nationally

Top ROI renovation: kitchen upgrades (56%).

Regional challenges: inventory in the Northeast, financing in the Southeast, and labor/material costs in the West.

Ralph’s Take

Opportunity still exists — but only for those who buy smart. With high financing costs, limited inventory, and renovation expenses remaining elevated, overpaying can quickly erase a flipper’s profit. My advice: stay disciplined, maintain realistic expectations for after-repair costs, and remain sharply focused on the acquisition price. In today’s competitive purchase market, especially when bidding wars come into play, your margin is won, or lost, at the point of purchase.

News That Just Missed the Cut

Mortgage Watch 📉

Today’s average 30-year fixed mortgage rate is up to 7.10% ( ⬆️ 0.55 from this time last week).

> The rate you may be eligible for can vary greatly from the daily average published via Mortgage News Daily.

Westchester Events

Saturday, April 12th - Sunday, April 13th

4/12: Earth Day Family Event, Yonkers

4/12: Full Moon Hike, Pleasantville

4/12: Harvest Moon Egg Hunt, North Salem

4/12: Patriots Park Egg Hunt, Tarrytown

4/12: Shaka Club 20s/30s Happy Hour, White Plains

4/12: Spring Egg Hunt, Bedford

4/12: Weir Tour, Ossining

4/12: Yonkers Waterfront Walking Tour, Yonkers

4/12 - 4/13: Chick & Bee Kids Pop-Up, Cross River

4/12 - 4/13: Easter Eggstravaganza, Rye

March 31st - April 13th:

Hudson Valley Restaurant Week

Spring Guides 🌻

This market is not perfect. I'm here to help.

Tour properties or learn your home’s value:

Reply, call, or text: (914) 202-1101

—

For an instant home value, including recent comparable sales and real time market trends in your area, Click Here

—

2024 List to Sell Ratios: MLS: 100.5% - Ralph: 105.6%

2024 Average Days on Market: MLS: 58 - Ralph: 25

With gratitude, Ralph 🫡

Know someone interested in real estate? Share this report. I’ll be your best friend. 😉