What a week!

🏀 Let’s GO KNICKS!! We’re up two games on the defending champion Boston Celtics, and you can score big with a rare opportunity to buy Allan Houston’s former home. Take a look!

✝ Pope Leo XIV Elected. As the Church welcomes new leadership, it’s a fitting time to reflect on the meaning of home, community, and fresh beginnings. Did you know that churches occasionally come to market — like this unique opportunity in Ossining.

💐 Happy Mother’s Day! This Sunday, we celebrate the incredible women who shape our homes and our lives. Whether you're a mom, celebrating a mom, or remembering one, I hope your day is filled with love, gratitude, and a little well-deserved rest.

Today’s Topics:

Cryptocurrency is up! Buy a home!

New Listings Drop Week-to-Week

What If You Bought Your Home in 1995?

End of Year Mortgage Rate Projections

Can You Buy a Home with Crypto? Yes, But Read This First.

Cryptocurrency saw gains this week, with Bitcoin surpassing $100,000 for the first time since February. The digital currency market has already disrupted banking, finance, and art. Now, it’s knocking at the door of real estate. Yes, you can buy a home with Bitcoin, Ethereum, or another digital currency. But before you start moving your Dogecoin to a cold wallet and house-hunting in Westchester, there are a few key things you should know:

Not All Sellers Will Accept Crypto:

The deal often requires converting your cryptocurrency into dollars through a third-party service or crypto-friendly escrow company. It’s rare (but not impossible) to find sellers willing to accept Bitcoin directly.

Crypto as a Down Payment:

If you're hoping to get a mortgage and fund the down payment with crypto gains, your lender will want those coins sold and seasoned in your account (usually for 60–90 days).

Crypto-Backed Loans:

If you prefer not to liquidate your crypto holdings, consider a crypto-backed loan. This involves using your digital assets as collateral to secure a loan for your home purchase.

Prepare for Tax Implications:

The IRS treats crypto as property, which means every time you sell, swap, or use it to buy something—like a house—it triggers a capital gains event. A $1M home paid for with appreciated Ethereum? That’s potentially six figures in taxes, depending on how long you’ve held it.

Ralph’s Take

Using cryptocurrency to buy a home is becoming more feasible — but it’s not exactly plug-and-play either. Crypto still works best as a funding source, not the payment method itself. Most sellers — and their attorneys — will still prefer a good old-fashioned wire transfer over blockchain confirmations that can lag or fluctuate in value. If you’re considering using digital assets in your purchase, transparency, legal clarity, and the right team behind you are non-negotiables. Deals get done when everyone feels secure — whether the funds come from Bitcoin or a checking account.

Westchester Weekly Market Tracker 📈

‘Coming Soon’ Listings: 45 ↑+17

New Listings: 265 ↓-99

Price Reductions: 80 ↑+7

Pending Sales: 207 ↑+36

Closed Sales: 141 ↓-12

💰 Notable Sale: 44 Wynnewood Road, Chappaqua: $1,150,000 - 35% over ask in 8 days.

Property Type: Residential. OneKey MLS, Inc. 5/2/25 - 5/9/25.

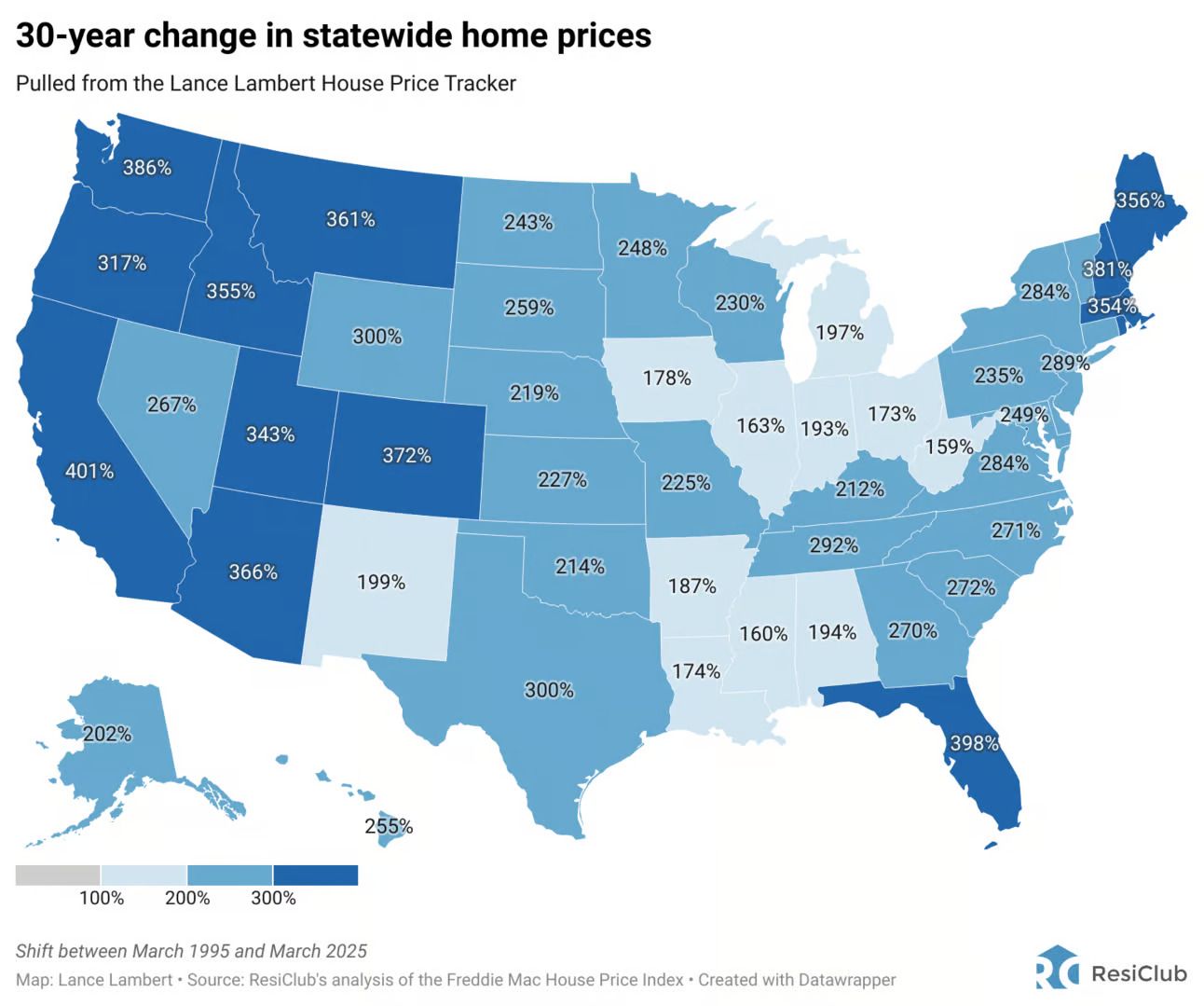

What If You Bought Your Home in 1995?

According to ResiClub's analysis of the Freddie Mac House Price Index, U.S. home prices surged by an impressive 300% from March 1995 to March 2025. Despite market fluctuations over the past three decades, homeowners experienced substantial gains in home equity, highlighting the enduring value of real estate as a wealth-building tool. Some may argue that stocks offer superior returns, noting that the S&P 500 Index rose by roughly 926% over the same period, but consider this:

Leverage: Home price gains can yield far higher returns on a buyer’s down payment due to mortgage leverage.

Opportunity Cost: Choosing to skip homeownership often means paying rent and underinvesting in the stock market, shifting how real returns compare.

Utility Value: Homes also provide shelter, stability, and access to community benefits like schools. Unlike stocks, owning a home often acts as a form of forced savings, helping build wealth in ways that renting typically does not.

Ralph’s Take

The fundamentals are unchanged: homeownership is both a place to live and a powerful financial asset. For many, it remains one of the most attainable and dependable ways to build long-term financial stability. Amid the noise of short-term market headlines, the experience of the 1995 homebuyer is a reminder of the value in taking the long view. Housing isn’t just about monthly trends — it’s about the wealth it can build over decades.

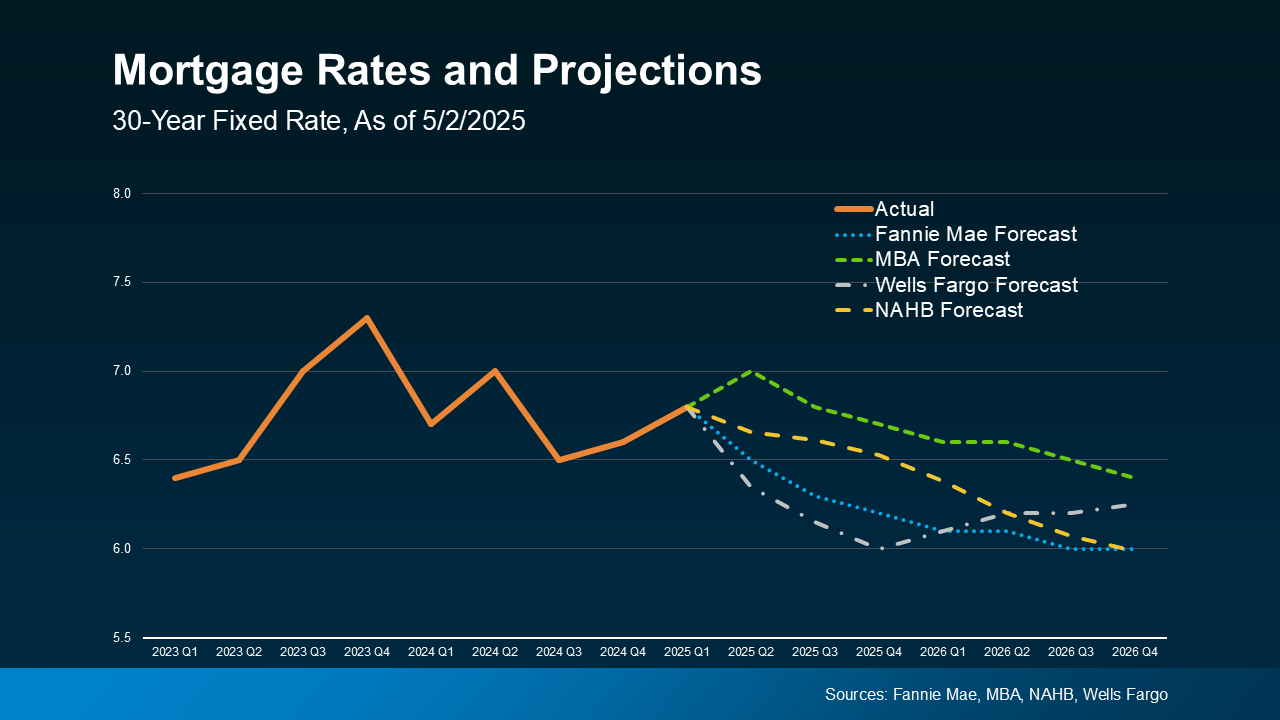

Mortgage Rates Are Projected to Come Down (Slightly)

While a significant drop in mortgage rates isn’t expected, the most recent forecasts suggest a modest decrease in the coming months as economic conditions become more stable. Experts anticipate rates will edge lower by the end of the year. Even a slight dip can positively impact monthly payments and offer some relief for homebuyers' budgets. Keep in mind that factors like inflation, employment trends, and overall economic shifts will continue to influence rate movements. I’ll keep you updated.

Just Missed the Cut

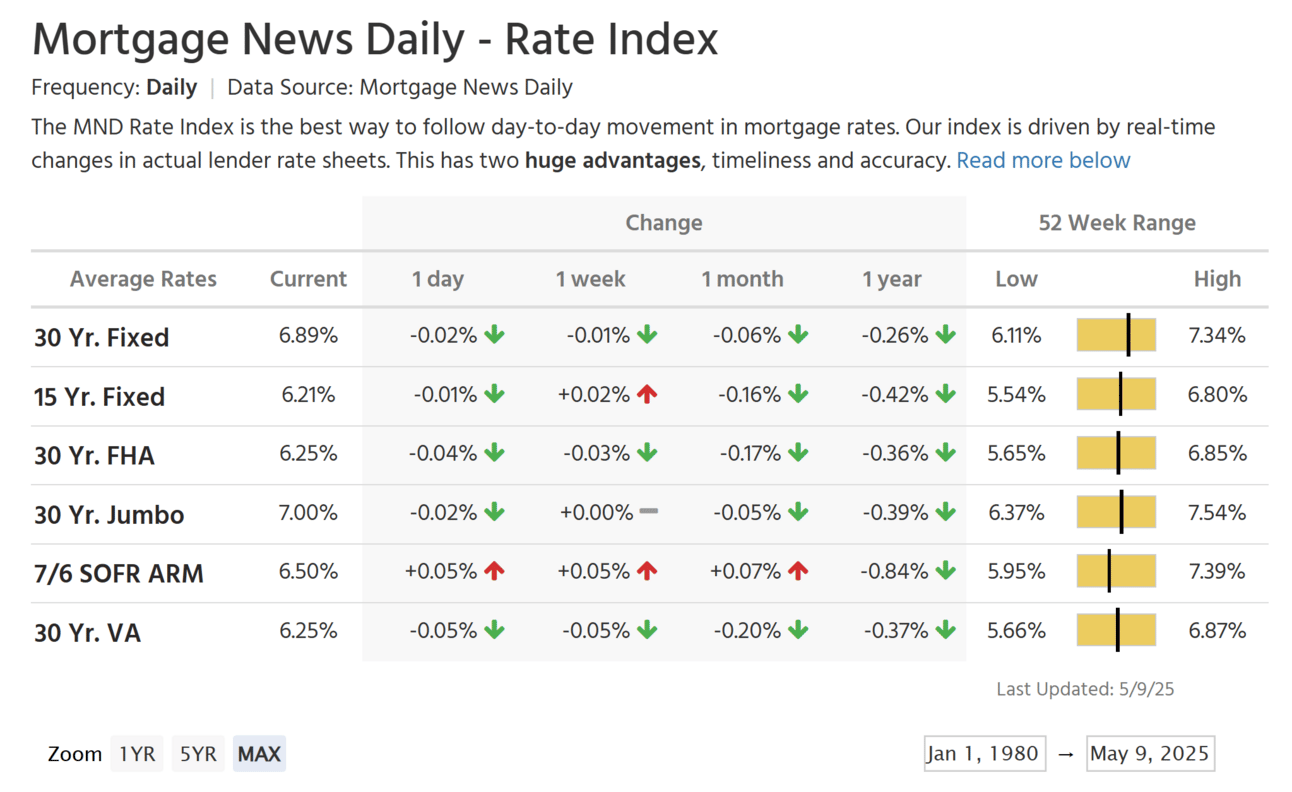

Mortgage Watch 📉

Today’s average 30-year fixed mortgage rate is relatively unchanged from last week, 6.89% (⬇️ 0.01 from this time last week).

Purchase application data continues to show strength, with an 11% increase week-over-week and 13% growth year-over-year.

> The rate you may be eligible for can vary greatly from the daily average published via Mortgage News Daily.

Westchester Events

Saturday, May 10th - Sunday, May 11th

5/10: Comedy From Scratch

5/10: Horeseman’s Harvest

5/10: Mother’s Day Market

5/10: Pinkster Jubilee

5/10: Suds on the Sound Craft Beer Festival

5/10: Teatown Plantfest

5/10: Wrestlefest XXVIII

510 - 5/11: Old Salem Farm Spring Horse Show

5/10 - 5/11: Spring Market at Makers Central

5/11: Bicycle Sunday

5/11: Cars and Coffee

5/11: Open Streets Tarrytown: Mother's Day

5/11: Super Spring Estates Auction

5/11: The Run Your Y (WHY) 5K

5/11: Yoga on the Farm

Farmer’s Markets are Back! 🤠

Saturday: Bronxville, Chappaqua, Greenburgh, Hartsdale, Larchmont, North Salem, Ossining, Pleasantville, Sleepy Hollow / Tarrytown

Sunday: Irvington, Mount Kisco, Rye, Tuckahoe

Spring Guides 🌻

Happy Mother’s Day! 💐

To Mom, Lori, Franny, and Laurie 💙

This market is not perfect. I'm here to help.

Ready to tour properties?

Reply, call, or text message me: (914) 202-1101

—

Learn your home's value and find recent comparable sales here

—

2024 List to Sell Ratios: MLS: 100.5% - Ralph: 105.6%

2024 Average Days on Market: MLS: 58 - Ralph: 25

With gratitude, Ralph 🫡