It’s Friday the 13th - Only 12 days until Christmas and just 19 days left in 2024!

As we close out the year, our sights are set on the opportunities ahead in 2025. Pandemic homebuyers could be making a strong return, while the luxury market continues to set its own pace. Plus, this week’s newsletter includes everything you need to know about navigating the appraisal process.

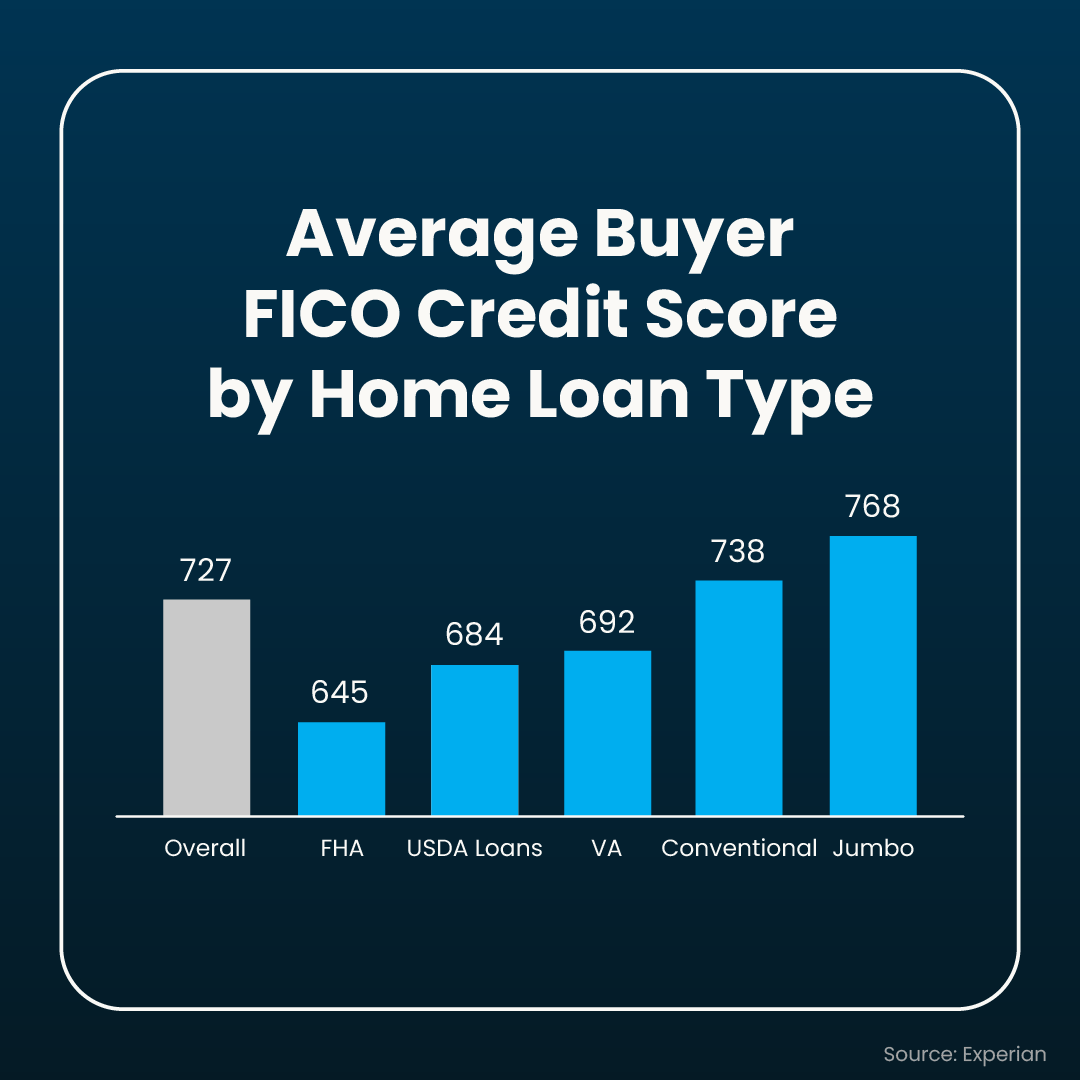

Here’s a fun one: Can you guess the average credit scores for different mortgage types?

The Pandemic Buyer Ready to Drive 2025

Younger Americans who purchased homes during the COVID-19 pandemic are expected to be the primary home sellers in 2025 according to a Bright MLS survey. These homeowners, particularly those in their 30s and 40s, are motivated by family and career changes, despite current mortgage rates averaging above 6%. Many secured mortgages with interest rates below 4% during the pandemic and have accumulated significant home equity due to a 37% increase in national median list prices over the past five years. In contrast, only about 6% of homeowners aged 60 and above plan to sell in 2025, with the majority owning their homes outright and expressing little interest in moving.

Ralph’s Take

Historically, homeowners moved every 6 to 7 years. However, by 2018, the median tenure had risen to 13 years, a trend further reinforced in the past three years by rising mortgage rates. During this time, first-time homebuyers made up 32% of sales in 2020 and 34% in 2021. Now, four to five years later, it’s likely that many of these buyers are starting to consider their next move.

Westchester Weekly Market Tracker 📈

New Listings: 100 ↓

Price Reductions: 41 ↓

Pending Sales: 126 ↑

Closed Sales: 174 ↑

Highest Sale: 16 Hazel Lane in Larchmont: $3,900,000 (+11%)

Property Type: Single-Family. OneKey Multiple Listing Service, Inc. 12/6/24 - 12/13/24.

The Resilience of Luxury Real Estate

The luxury housing market has shown significant growth in 2024, diverging sharply from the broader housing market, which faces stagnation due to high mortgage rates. According to HousingWire, homes priced at $1 million or higher saw a 5.2% sales increase and a 14.2% median price rise, compared to a 12.9% drop in overall home sales. In addition:

Nearly half of luxury sales in Q1 2024 were cash transactions.

The S&P 500 and Dow Jones rose by 26.9% and 17.9%, enhancing buyers' wealth.

$31 trillion in generational wealth transfers are expected over the next decade.

Ralph’s Take

Affluent buyers, often paying in cash, remain largely unaffected by rising borrowing costs. While affordability challenges weigh on the broader market, the luxury sector continues to thrive, with at least half of its transactions being all-cash deals. A strong stock market and growing home equity have further fueled high-end purchases. Looking ahead, the transfer of generational wealth promises to be transformative over the next decade, as Millennials and Gen X prepare to inherit substantial assets.

Making Sense of the Appraisal Process

The National Association of Realtors® (NAR) just released a consumer guide called “The Appraisal Process." It provides a comprehensive overview of home appraisals, detailing their purpose, the steps involved, and the rights of consumers during this phase. It also highlights the role of appraisals in determining the fair market value of a property and explains the factors that appraisers consider during evaluations. Key topics include:

What is an appraisal?

Do I have to get an appraisal?

What does an appraiser look at?

What if the appraised value is different from the purchase price?

Can I request that an appraiser correct or update the appraisal?

Ralph’s Take

This guide is a valuable resource, especially for those new to the real estate appraisal process. I’m happy to see NAR provide a consumer guide for a topic that is often confusing and plays a significant role in most transactions. 👏

Grow and Invest in Your Future

A friend recently told me about Acorns, and I’ve been really impressed by how easy it is to use. It’s such a simple way to take control of your finances and save for your retirement, build an emergency fund, or start investing. What I really love is the “round-up savings” feature, which automatically invests my spare change from everyday purchases. Check out Acorns - I promise, you’ll be glad you did!

Visual of the Week 🖼️

Credit scores are a factor in home financing, determining the types of loans a borrower can qualify for and the terms they receive. The average FICO credit score for homebuyers overall is 727, but requirements vary by loan type. The good news is you don’t need perfect credit to purchase a home. Contact me to learn more about home loan options that may work for you.

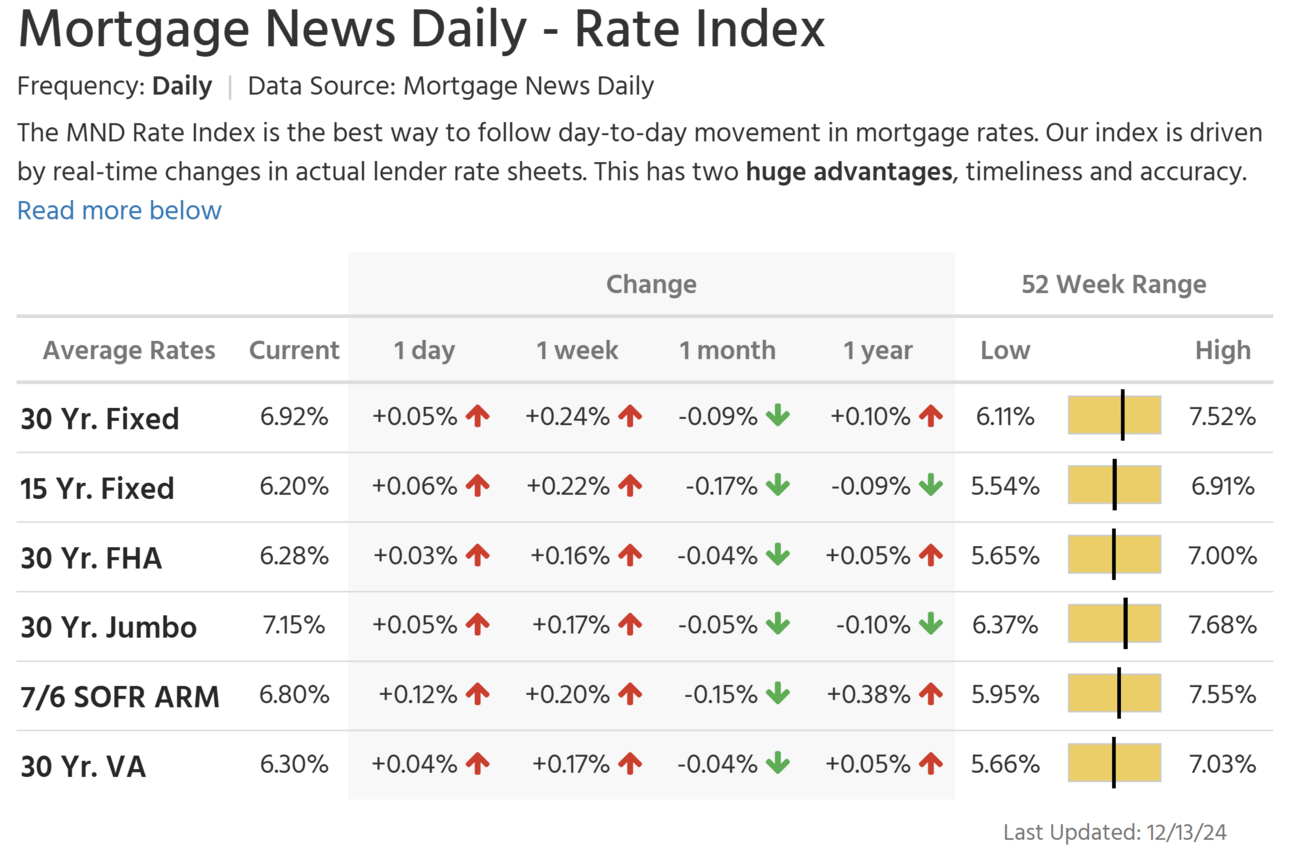

Mortgage Watch 📉

Mortgage rates moved modestly higher this week. Today’s average 30-year fixed rate is 6.92%.

> The rate you may be eligible for can vary greatly from the daily average published via Mortgage News Daily. I use this figure as a proxy for how the mortgage market is shifting.

Westchester Events

Friday, December 13th

12/13: Frozen Extravaganza

12/13: Holiday Lights on the Farm

12/13: Holiday Stroll

12/13: Shake it Off’s Grinchmas

Saturday, December 14th - Sunday, December 15th

12/14: A Very Jazzy Christmas

12/14: Breakfast with Santa

12/14: Christmas Concert

12/14: Hanukkah Celebration

12/14: Holiday Craft Fair

12/14: Marvelous Mammals

12/14: Shop Local Holiday Trolley

12/14: Skate with Santa

12/14: The Nutcracker

12/14: Winter Spectacular

12/14: Winter Stroll

12/14 - 12/15: Glad Tidings

12/14 - 12/15: Holiday Weekend Pop Up Market

12/14 - 12/15: Holiyay Market

12/15: Christmas Handbell Concert

12/15: Christmas With Chris Ruggiero

12/15: Interactive ELF Screening

12/15: Santa Brunch

12/15: Santa's Workshop on Wheels

Winter Real Estate Guides ☃️

This market is not perfect. I'm here to help.

With gratitude, Ralph 🫡

Schedule a consultation to develop your 2025 game plan now.

Reply to this email, call, or text message me anytime at (914) 202-1101.