Sell or Buy First - That Was the Second Question

A happy buyer and seller on closing day

The guy on the right is one of my oldest friends, his name is Brian and we’ve known each other since 1st grade. His first question came earlier this year, when he proposed to his fiancé. Soon after they decided it was time to buy a home together in Long Island.

His next big question was to me: Should they sell or buy first?

Given the local market — we knew his home would sell quickly and the homes he would want to buy would be highly competitive — the answer was clear: Buy first.

Brian and his fiancé started to attend open houses, explore neighborhoods, and familiarizing themselves with local inventory and prices. Meanwhile, we prepared his home for sale, took professional photography, created a marketing plan, and had ongoing discussions about the right asking price.

After losing out on a few bidding wars, they finally had an offer accepted.

We listed Brian’s home immediately, and within a week, he had 23 offers to choose from (more on that process in an upcoming newsletter). Last Wednesday, he closed on the sale, and the very next day, he closed on the purchase of his new home with his fiancé - Congratulations Brian and Tanya! 🥂

Ralph’s Take

If you're unsure whether to sell or buy first, let's schedule a quick call. Brian was fortunate to secure his new home before selling, but every market is different, and activity can vary across price ranges. I would be happy to review your situation and provide the information you need to simplify the process and make the most informed decision possible.

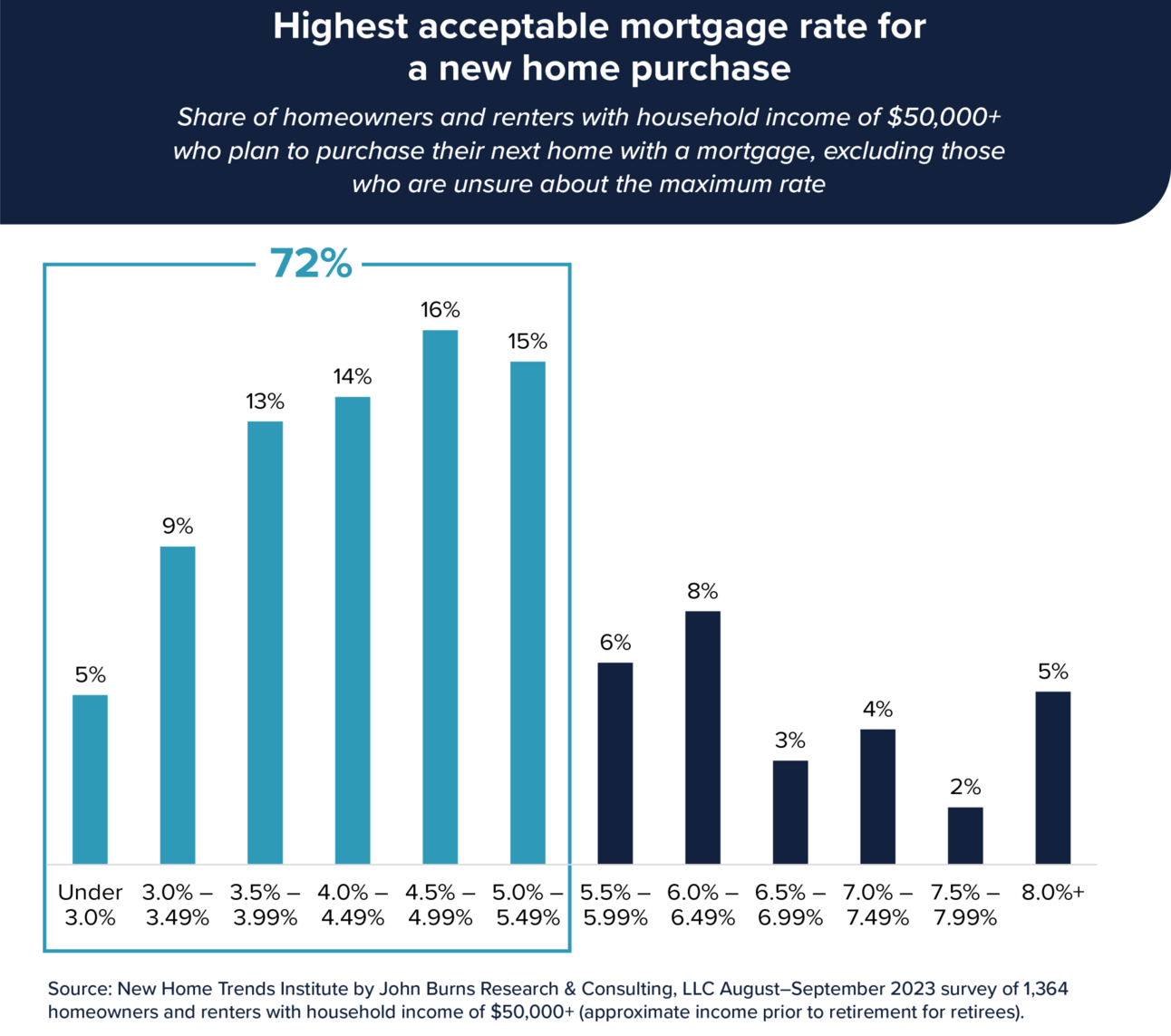

Could This “Magic Rate” Unlock the Market?

According to a recent analysis by John Burns Research and Consulting (JBREC), there may be a "magic" mortgage rate that could spark renewed activity in the housing market. For 12 consecutive years, mortgage rates remained below 5%, enabling many homeowners to lock in favorable terms. Currently, 86% of mortgage holders have rates under 6%. JBREC's survey suggests that the 5.5% mortgage rate represents the tipping point that could release the “ lock in effect ”. Additional findings:

72% of buyers would not accept a rate above 5.5%

22% of buyers would accept a rate higher than 6%

66% of consumers believe a “normal” rate is below 5.5%

88% of consumers believe rates will drop below 5.5% within 5 years

Ralph’s Take

While many homeowners are still reluctant to sell due to the current mortgage rates, this hesitation is easing. That explains the gradual rise in listings this year. For the first time, we have data showing when homeowners might be ready to sell and buy in larger numbers. The 5.5% rate is more of a guideline than a strict cutoff, but it helps us predict market trends. If rates dip below 6% as expected, we may see a major market shift in 2025.

Luxury Home Sales Jump by Double Digits in Q3

In the third quarter of 2024, luxury home sales in markets north of New York City saw significant growth, with double-digit increases in Westchester, Putnam, and Dutchess counties. The lower end of the luxury market experienced the bulk of the activity, while sales of homes priced above $5 million slowed.

Westchester County Luxury Sales | ($2M and Higher) |

|---|---|

Homes Sold: | Up 23.9% |

Median Sale Price: | Down 3.4% |

Q3 Highest Sale Price: |

Ralph’s Take

The ongoing strength of the stock market, combined with a recent decline in interest rates, offers promising signs for the luxury real estate market. However, with the presidential election just a month away, uncertainty lingers as luxury buyers often delay decisions until after the results. This hesitation stems from the unpredictability elections bring to economic policies, tax laws, and overall market stability, which can directly influence high-net-worth individuals and their real estate investments, including potential changes to capital gains and income taxes.

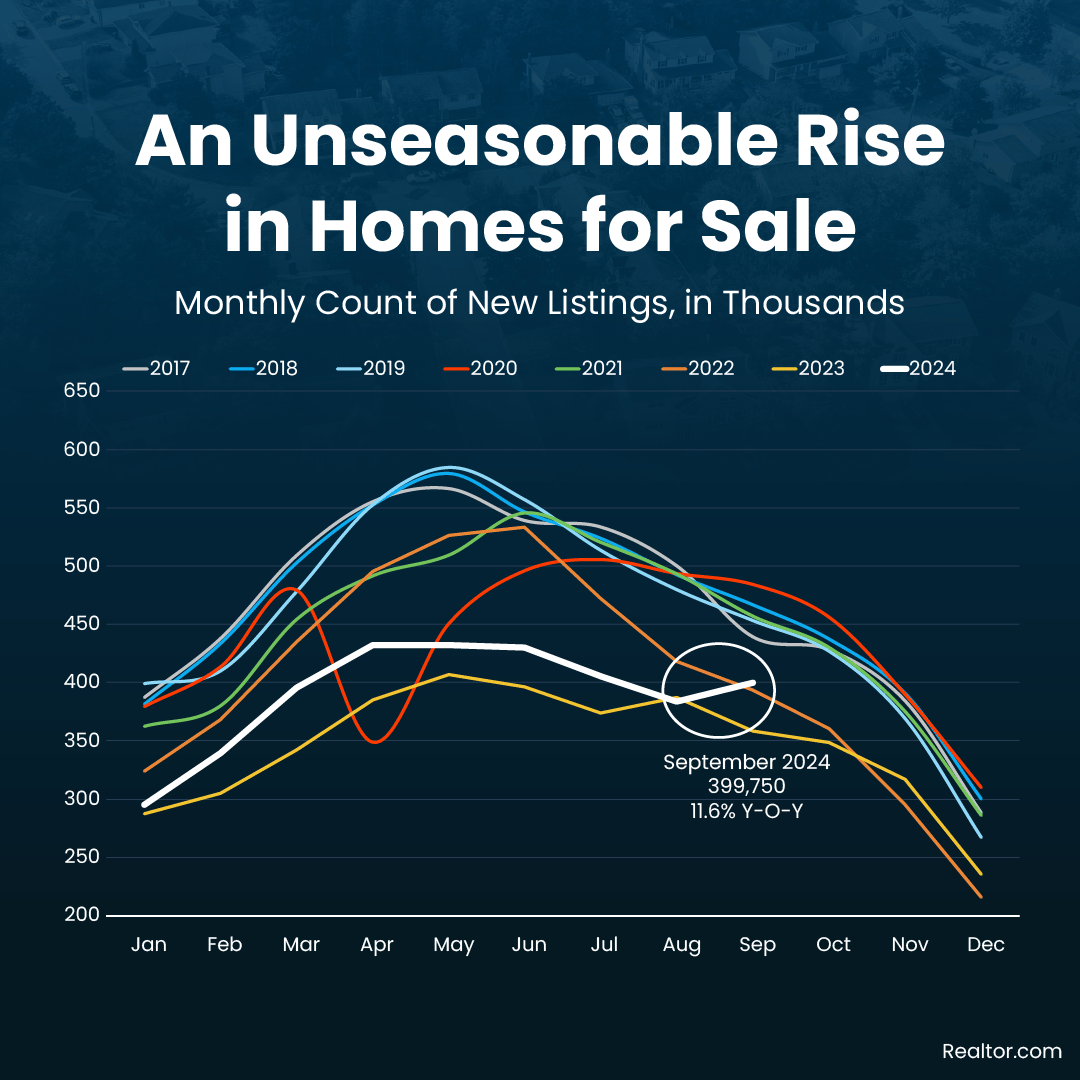

Visual of the Week 🖼️

More homes just hit the market – and that doesn’t usually happen in the fall.

Now might be the perfect time to buy a home. According to Lawrence Yun, Chief Economist at NAR, the current increase in available homes puts buyers in a stronger position with better pricing options. While mortgage rates are slightly higher than last month, they’re expected to dip again by year-end, improving affordability.

In Westchester, inventory typically peaks in spring and summer, and this year, the highest number of new listings came in April, although we had a nice bounce in September. Waiting for lower rates could mean fewer options later, especially as home prices continue to rise due to limited supply. If you’re financially ready, moving forward now could be a smart decision.

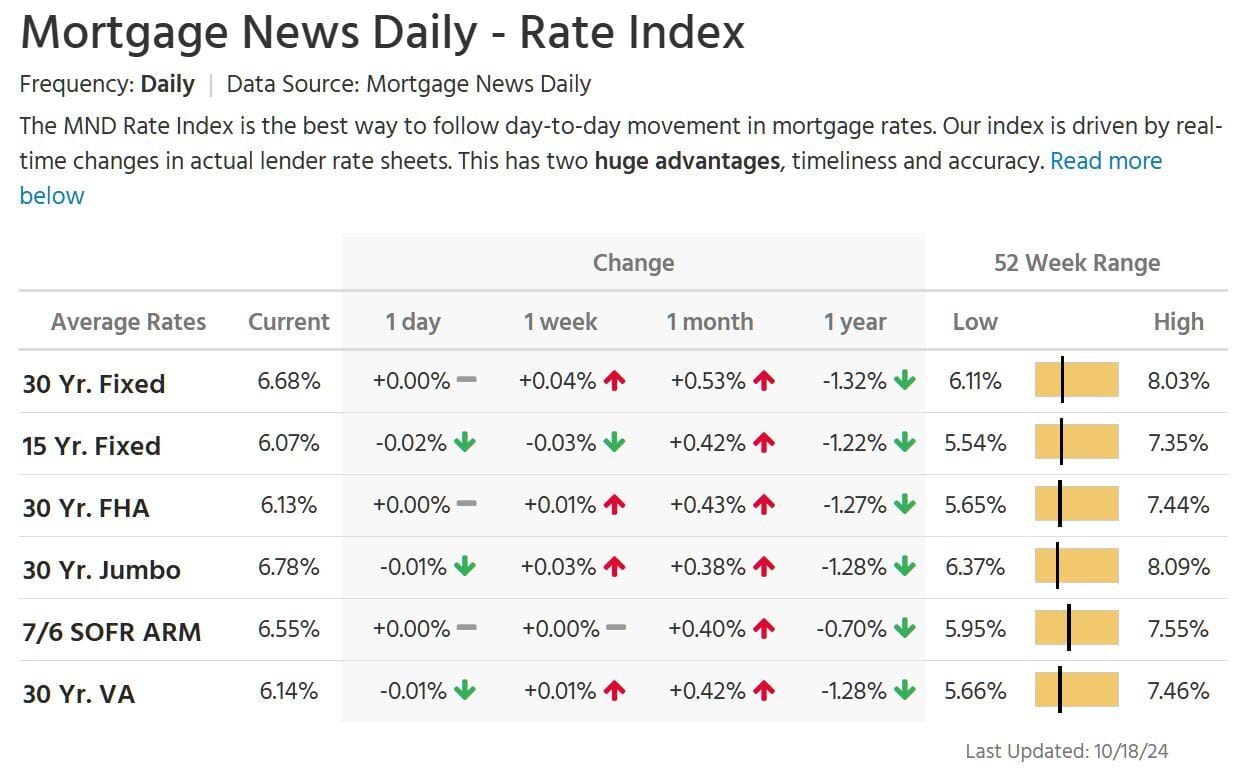

Mortgage Watch 📉

Since reaching a high of 7.52% in April, the average 30-year fixed mortgage rate continues to drop. Today’s rate is 6.68%, nearly unchanged from a week ago.

> The rate you may be eligible for can vary greatly from the daily average published via Mortgage News Daily. I use this figure as a proxy for how the mortgage market is shifting.

Friday, October 18th:

10/18: Winkle vs. Horseman Block Party,

10/18 - 10/19: Nightmare Circus

10/18 - 10/19: Sleepy Hollow Block Party

Saturday, October 19th - Sunday, October 20th:

10/18 - 10/19: Sleepy Hollow Block Party

10/19: Bedford Art Crawl

10/19: Katonah Art Walk

10/19: Katonah Fire Dept Backyard Blaze

10/19: Ridgetoberfest at Ridge Hill

10/19: Tails of Hope Rescue Gala

10/19 - 10/20: Harvest Moon Fall Festival

10/19 - 10/20: Outhouse Orchards Fall Festival

10/19 - 10/20: Salinger’s Fall Festival

10/20: Halloween Parade and Trunk or Treat

10/20: Halloween Window Painting Contest

10/20: Ragamuffin Halloween Parade & Festival

10/20: River Pumpkin Fest

10/20: Trick or Treat at the Muscoot Farm

10/20: Spooktacular Sunday

10/17 - 11/2: Halloween at the Hall

Ongoing thru 11/2: Scared by the Sound

Ongoing thru 11/17: The Blaze

This market is not perfect. I'm here to help.

Schedule a consultation to develop your end-of-year or 2025 game plan.

Email, call or text message me at (914) 202-1101.

Thanks for reading and enjoy the weekend!

-Ralph 🫡